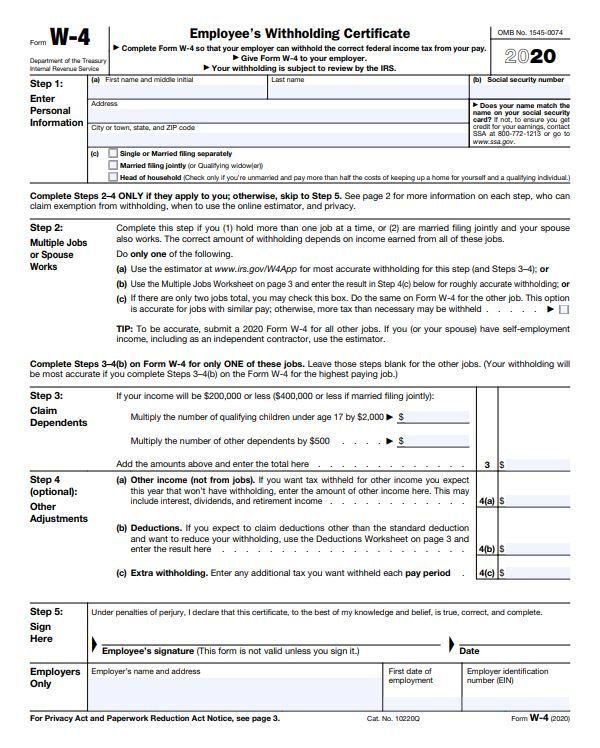

Multiple Jobs Worksheet W4 2020

Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. Jobs 4 days ago What if I dont want to reveal to my employer on my W-4 that I have a second job12.

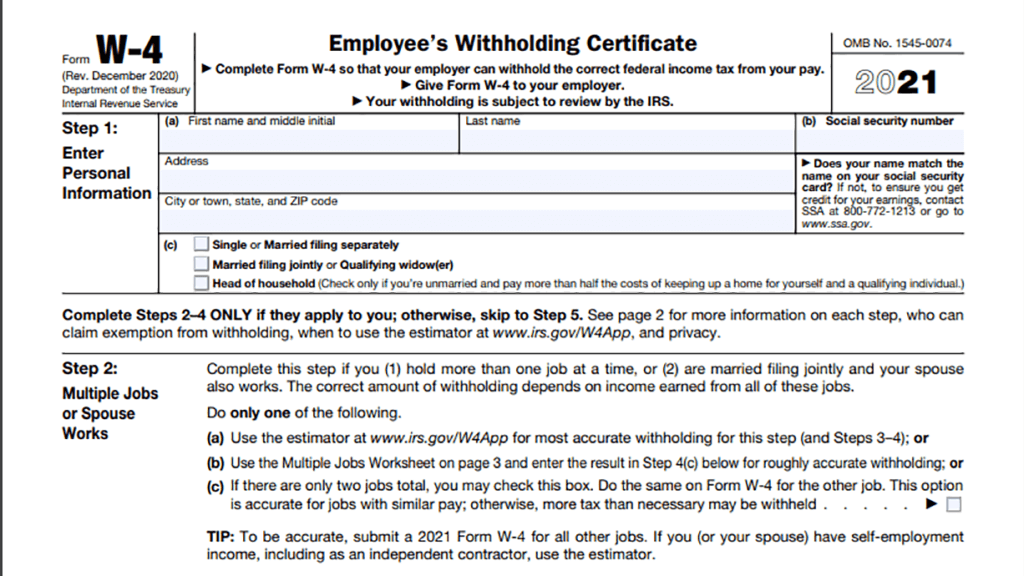

Form W 4 How To Fill Out The New W 4 Form

Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job.

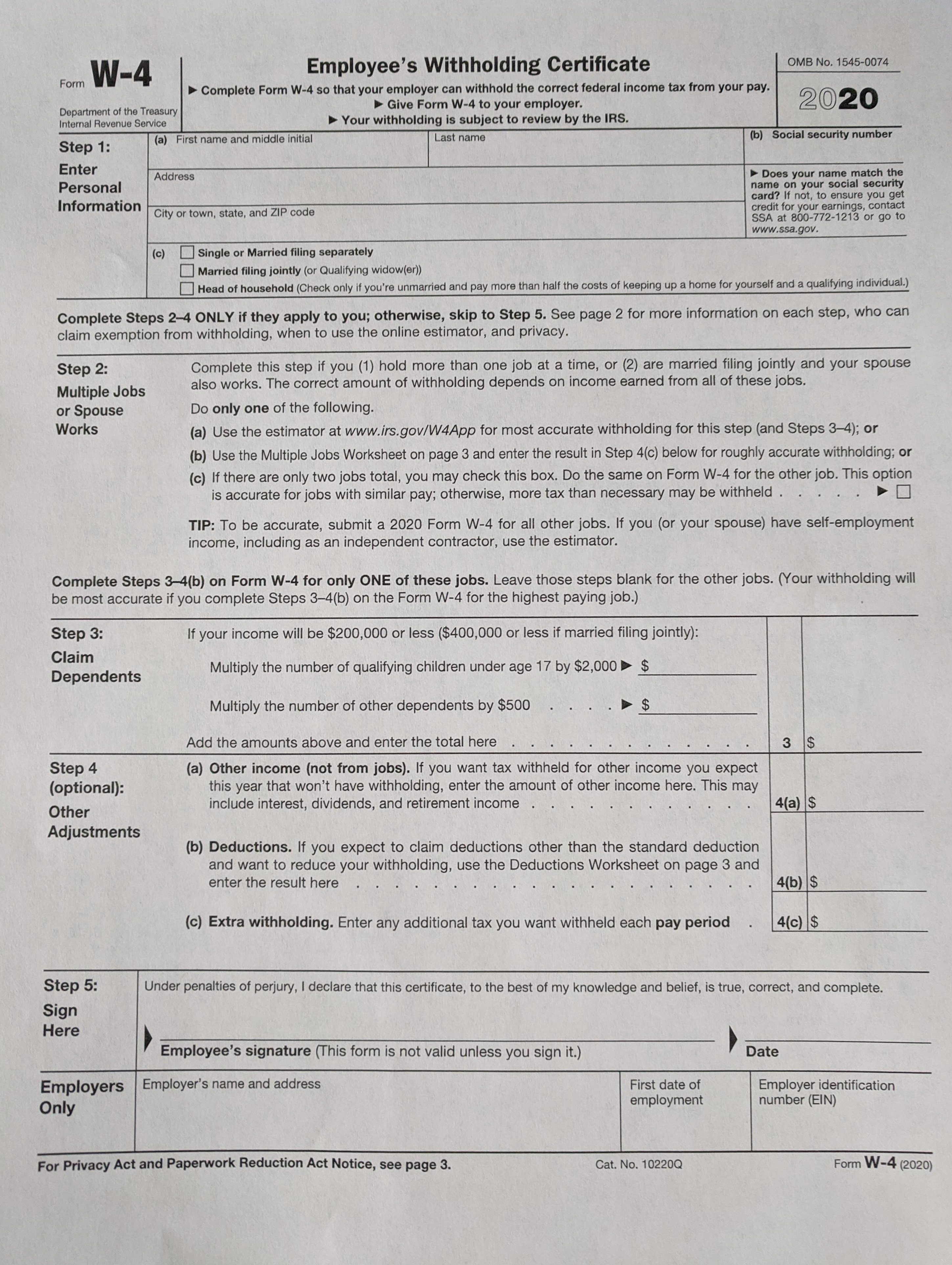

Multiple jobs worksheet w4 2020. Line 1 If the employee has two jobs or theyre married filing jointly and their spouse also has a job the employee should fill in Line 1 of the worksheet by using the withholding tables on page 4 of Form W-4 which have columns for the highest paying job on the left and the lowest paying job. The worksheet for calculating the personal exemptions is removed in the updated version of Form W-4. Lets begin with Step 1.

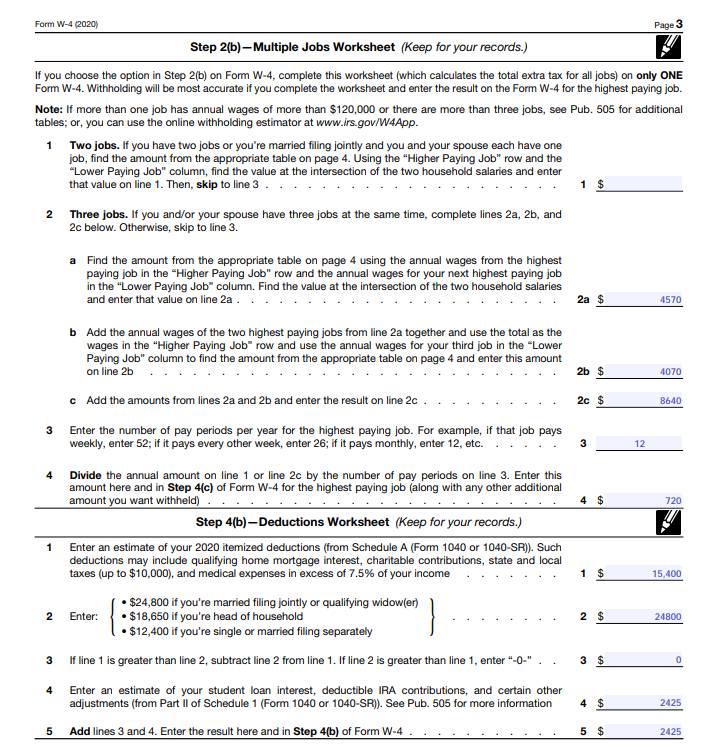

Here we have another image This Year Is Different Revisit Your Withholding Elections featured under 2020 W 4 Guide. Step 2bMultiple Jobs Worksheet Keep for your records If you choose the option in Step 2b on Form W-4 complete this worksheet which calculates the total extra tax for all jobs on. Enter Personal Information a First name and middle initial Last name and address City or town state and ZIP code b Social security number c Filing status.

There are now three main sections used to help determine your withholding. In 2020 Form W-4 is a bit easier to understand because each section shows why adjustments are being made. FAQs on the 2020 Form W-4 Internal Revenue Service.

Or c If there are only two jobs total you may check this box. You only complete each section if it applies to your situation. 505 for additional tables.

This worksheet works for Form W-4 from before 2020 and 2020 or later this method also works for any amount of wages for any pay period. Or you can use the online withholding estimator at wwwirsgovW4App. The instructions above Step 3 say that in multiple job households adjustments in Steps 3 4b are to be made on only one form and that withholding will be most accurate if the adjustments are made on the W-4 for the highest paying job.

If you prefer not to use the estimator tool or you cant get it to work you can use the multiple jobs worksheet. If more than one job has annual wages of more than 120000 or there are more than three jobs see Pub. To calculate the number of allowances you could use separate worksheets that many found complicated.

Like Step 1 Step 3 is also relatively simple. Same as the 2020 Form W-4 the 2021 Form W-4 has only two worksheets down from three on the 2019 form. It is only necessary to calculate estimated tax liabilities for the extra income if the combined income from your two jobs exceeds 40000 as of the current year.

505 for additional tables. Enter the number from the Personal Allowances Worksheet line H page 1 9 9 Add lines 8 and 9 and enter the total here. Depending on the number of jobs the employee andor spouse holds they can fill out the worksheet as follows.

Use the Multiple Jobs Worksheet. If you choose option b in Step 2 you will need to complete the Multiple Jobs worksheet. Otherwise more tax than necessary may be withheld.

If you plan to use the Two-EarnersMultiple Jobs Worksheet also enter this total on line 1 below. The two during the class room and on straight into in the future life. Here is a breakdown of each area.

Is W4 Form And Does It Work For Multiple Jobs Worksheet 2020 worksheets missing number puzzles math editor 8th std math syllabus graph of a line add 10 game Its a worksheets Adventure. Instead of allowances the 2020 W-4 calls for completing a series of steps. 29 06022021 081621 pm 1024 682 W4 Worksheet.

Well cover both here so you can understand if you should use them and why. The worksheets on the W-4 will help you estimate your tax liability when you have multiple jobs. See also 2018 Tax Forms W4 Elegant Two Earners Multiple Jobs from Printable Multiplication Topic.

This option is accurate for jobs with similar pay. A list of job recommendations for the search two earners multiple jobs w4 is provided here. Do the same on Form W-4 for the other job.

Otherwise stop here and enter this total on Form W-4 line 5 page 1 10 10. Or you can use the online withholding estimator at wwwirsgovW4App. However the IRS retained worksheets such as Multiple Job and Deduction in the 2020 Form W-4.

Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. If more than one job has annual wages of more than 120000 or there are more than three jobs see Pub. If your spouse works and you file jointly or if you have a second or third job you can use either the IRS app or the two-earnersmultiple jobs worksheet page three of the W-4 instructions to calculate how much extra should be withheld you put this amount in Step 4.

Follow the instructions on the Form and input the final result in Step 4c as an extra withholding. Multiple Jobs Worksheet May 17 2020 October 8 2020 Multiplication by admin In the beginning the kids might not appreciate receiving more due diligence although the advantages they may profit from honing the saw and rehearsing their math will serve them well. No More Personal Allowance Worksheet The Tax Cuts and Jobs Act eliminates personal exemptions too.

2020 W 4 Guide. B Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4c below for roughly accurate withholding. How To Fill Out A W 4 This Year Gusto Uploaded by admin on Wednesday November 4th 2020 in category Printable Multiplication.

If there are only two jobs ie you and your spouse each have a job or. All of the job seeking job questions and job-related problems can be solved. Multiple Jobs or Spouse Works.

Making Sense Of Irs Form W 4 Changes Syndeo

What Is A W4 Form And How Does It Work Form W 4 For Employers

This Year Is Different Revisit Your Withholding Elections Now Merriman

This Year Is Different Revisit Your Withholding Elections Now Merriman

What You Should Know About The New Form W 4 Atlantic Payroll Partners

W 4 Form Printable For 2020 Get Irs W4 Form Sample To Print In Pdf Download Fill Online W 4 Tax Form With Instructions Guide

New 2020 Form W 4 Answerline Iowa State University Extension And Outreach

How To Fill Out And Change Your Form W 4 Withholdings

How To Fill Out The W 4 Tax Withholding Form For 2021

Form W 4 How To Fill Out The New W 4 Form

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

W 4 Form How To Fill It Out In 2021

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2021

Tips For Filling Out The New W 4 Form

:max_bytes(150000):strip_icc()/Deductions-Worksheet-3ac3d23a5f51472e98e676fcc3f88fcf.jpg)

W 4 Form How To Fill It Out In 2021

W 4 Form How To Fill It Out In 2021

What You Should Know About The New Form W 4 Atlantic Payroll Partners

How To Fill Out And Change Your Form W 4 Withholdings

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2021

This Year Is Different Revisit Your Withholding Elections Now Merriman